The Importance of Integrity

Deel dit bericht

We are witnessing a surge in environmental, social and governance (ESG) investment across the investment industry, from index management to active and beyond. Global inflows accelerated in the first quarter of 2021 with $56.9 bn vs $44.1 bn in Q4 2020. The total ESG ETF assets under management (AuM) is now close to $265bn globally, and $161.3bn in Europe 1.

Implementing ESG in index strategies

A passive investor has two axes through which to integrate ESG values in their investment strategy. The first is the investment itself – using the full spectrum of sustainable indices to find one that aligns with the investor’s values and investment objectives. This could be a simple exclusionary approach removing a specific exposure or a more stringent best-in-class index. However, by stopping with this first axis, investors could be missing an opportunity to increase their impact; it is by digging deeper that they can fully integrate their values – using the axis of engagement.

But for most ETF investors conducting due diligence the primary focus is index selection followed by the choice of a fund. Ensuring the index is aligned with the investor objectives is very important. And checking that the product tracks the index consistently is essential, as is finding a fund at the right price. But what about the ETF provider, why does that matter?

Aligning your voice

The assets invested through index-tracking vehicles qualify for the same shareholder rights as actively managed holdings. Using those rights is a valuable way for asset managers to drive sustainable change and to ensure that investor objectives are met. For example, an investor may choose a climate index-tracking ETF because they believe in the importance of meeting the goals of the Paris agreement. But what if the ETF provider they had selected was using their shareholder rights to vote against climate resolutions. Would that be aligned with the investor’s values and objectives?

Looking beneath the surface

With most ETF providers now offering ESG solutions, it is important to look beyond the marketing and examine what lies beneath to ensure investors achieve the maximum impact with their ESG allocation. For example, what are the asset managers voting and engagement policies? Do their voting records match their rhetoric… and investors’ core values?

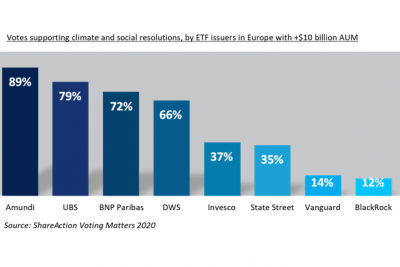

Most managers now publish their policies and reporting transparently on their websites, but a third-party perspective is also valuable. One organisation that reports on the voting activity of the largest asset managers is ShareAction, their Voting Matters 2020 report looks specifically at the climate and social impact voting activity of 60 leading asset managers.

When it comes to the largest ETF issuers in Europe, we note a real disparity in the approach to voting on climate and social issues (shown in the chart), underscoring the need for investors to ensure that the ETF they are buying is managed in a way that supports the overall investment objective.

Any experienced index manager should be able to track an ESG index, but a credible leader in ESG indexing will be able to go a step further and demonstrate the impact of their engagement and voting. Amundi has a comprehensive approach to shareholder advocacy, extending across both index and active investments and we are proud to have a strong and credible voting record.

To learn more about Amundi’s track record on voting and engagement, read our article.

Important Information

This document is not intended for citizens or residents of the United States of America or to any “U.S. Person”, as this term is defined in SEC Regulation S under the U.S. Securities Act of 1933. The “US Person” definition is provided in the legal mentions of our website www.amundi.com. Investors are subject to the risk of loss of capital. Promotional & non-contractual. Information which should not in any way be regarded as investment advice, an investment recommendation, a solicitation of an investment offer, or a purchase of any financial securities. The accuracy, completeness and relevance of the information, forecasts and analyses provided are not guaranteed. They have been prepared from sources considered reliable and may be altered without prior notice. The information and forecasts are inevitably partial, provided on the basis of market data observed at a particular moment, and are subject to change. This document may contain information from third parties that do not belong to Amundi (“Third Party Content”). Third Party Content is provided for information purposes only (for illustration, comparison, etc.). Any opinion or recommendation contained in Third Party Content derives exclusively from these third parties and in no circumstances shall the reproduction or use of those opinions andcommendation by Amundi AM constitute an implicit or explicit approval by Amundi AM. Information reputed exact as of January 2019.

Reproduction prohibited without the written consent of the Management Company. Amundi ETF designates the ETF business of Amundi Asset Management. This Document was not reviewed/stamped/approved by any Financial Authority. Amundi ETF funds are neither sponsored, approved nor sold by the index providers. The index providers do not make any declaration as to the suitability of any investment. A full description of the indices is available from the providers. This document is being issued inside the United Kingdom by Amundi which is authorised by the Autorité des marchés financiers and subject to limited regulation by the Financial Conduct Authority (“FCA”). Details about the extent of regulation by the FCA are available on request. This document is only directed at persons who are professional clients or eligible counterparties for the purposes of the FCA’s Conduct of Business Sourcebook. The investments described herein are only available to such persons and this document must not be relied or acted upon by any other persons. This document may not be distributed to any person other than the person to whom it is addressed without the express prior consent of Amundi.

Amundi Asset Management, French “Société par Actions Simplifiée” – SAS with capital of €1,086,262,605 – Portfolio Management Company approved by the AMF (French securities regulator) under no. GP 04000036 – Registered office: 90 boulevard Pasteur, 75015 Paris – France. 437 574 452 RCS Paris.

Footnote

1 Source: TrackInsight, ESG Observatory, Q2 2021

"The best investment you can make is an investment in yourself.

The more you learn, the more you will earn."

- Warren Buffett

Ontvang de nieuwsbrief

Schrijf je in voor één van de drie nieuwsbrieven en blijf op de hoogte over precies datgene wat jou interesseert.

• Maandelijkse nieuwsbrief

• Nieuwsbrief ETF's

• Nieuwsbrief aandelen

© 2025 Markets Are Everywhere.

Alle rechten voorbehouden